KL’s condo rental yields decline but market remains positive

Leasing out a property to earn rental income while waiting for its value to grow is a common investment strategy. It allows owners to gain returns on their investment and help offset their monthly instalments. Some of the more fruitful acquisitions may even earn their proprietors some extra income.

Against the current shadows looming over the property market in the country, is this strategy still as rewarding? What is considered decent rental gains in such a climate?

Some clues can be gleaned from the National Property Information Centre’s (Napic) data, which showed the best performing non-landed projects in KL garnering yields of 5.5% to 5.8% last year among 15 other condominiums in Kuala Lumpur that enjoyed gross rental yields of above 5%.

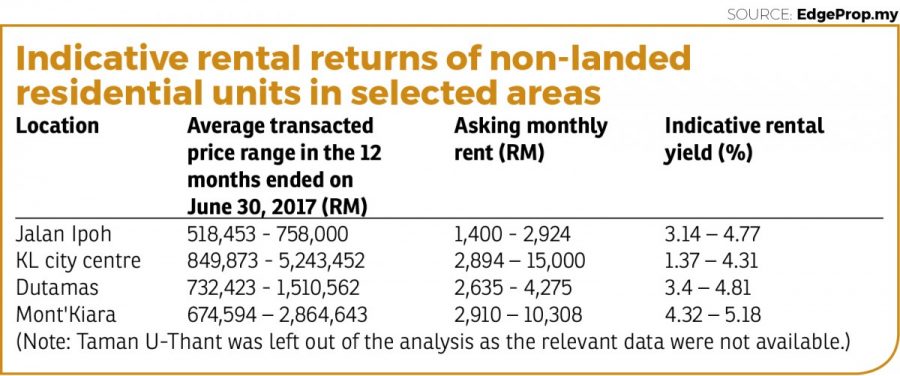

These profitable properties are located in areas such as KL city centre, Taman U-Thant, Mont’Kiara, Jalan Ipoh, Dutamas, Bangsar, Brickfields, Wangsa Maju, Cheras and Sentul.

The five condominiums with the highest rental yields recorded last year were Putra Majestik (5.8%) at Jalan Ipoh, St Mary Residences (5.7%) in KL city centre, Hartamas Regency I in Dutamas (5.7%), U-Thant Residence in Taman U-Thant (5.6%) and La Grande Kiara at Mont’Kiara (5.5%).

Lower but still good yields

Napic’s data showed that the top five highest rental yields recorded last year were lower than those in 2015, when yields ranged from 6.6% to 8.8%. The five best performing condos then were Menara Putra (rental yield of 8.8%), Casa Kiara II (7.5%), U-Thant Residence (6.9%), Seni Mont’Kiara (6.6%) and Mont’Kiara Astana (6.6%).

Although overall rental yields achieved in 2016 were generally lower than in 2015, CBRE | WTW managing director Foo Gee Jen feels that the yields of 5.5% to 5.8% achieved in 2016 are still considered good compared with returns from other investment choices, such as the 3.6% average gross dividend yield of companies listed on Bursa Malaysia.

“Furthermore, yields can be higher or lower depending on the location, current market situation and the strategies adopted in attracting tenants,” he tells EdgeProp.my.

Currently, the rental market in the five locations where the top five condos are situated is stable although rental yields have generally declined due to the increase in property prices, he says.

Foo attributes the lower returns to the increase in capital values and transaction prices of condos, which have increased at a higher rate than rents.

“Prices continue to rise faster than rents. Inflation, the rising cost of construction and the prices set by developers for new launches have partly contributed to this. However, sales rates have declined significantly, reflecting buyers’ perceptions that sale prices are too high compared with existing market rents,” he says.

He also notes that most tenants in the respective areas are locals except in KL city centre where more expatriate tenants are found.

Meanwhile, Vivahomes Realty team manager Allen Lee describes the competition in the condo rental market in KL as “rather stiff” although rental demand remains promising.

“Landlords have been slashing their asking rents to attract tenants, which in turn has impacted rental returns,” says Lee, who specialises in the KL city centre (KLCC) area.

This is because more new condos have come up over the past two years, such as Three28 Tun Razak, The Horizon Residences, Pavilion Banyan Tree and Face Platinum Suites, which have prompted tenants to move from the old condos to the new ones, thus impacting rental returns, he adds.

Propstar Realty team manager Kevin Teh, who is also familiar with the area, notes that another factor for the sluggish rental market is the downturn in the oil and gas industry, which has caused some property owners, not only in KL, to endure early termination of tenancies.

“Some property owners had to cut rents. This could be felt strongly especially in the KLCC area, where the expat market is the main tenant group,” he says.

Opportunities for good buys

Looking ahead, Foo foresees the KL non-landed residential rental market to remain weak with rental yields being further compressed.

“The KL rental market in 2018 is expected to decline further in the face of more condominiums and apartments nearing completion. While rentals of newly completed condominiums will reflect current rental levels, rentals at older developments may decline substantially,” he says.

However, there may be more opportunities to invest in a weak market as more sellers may be willing to compromise on prices, he adds.

Teh concurs that there are good buys in the KL city area at the moment, adding that the market will eventually recover.

He cites KLCC as an example. “If we zero in on the KLCC market, there are still some condos with good rental yields, especially the small- to medium-sized condos. These types of condo went through a dip last year in both sales and rental, but the situation improved at the turn of the year in 2017.

“There are some good buys around. For instance, you can get a really decent small unit at St Mary Residences at RM1.45 million with a return of 4%. Depending on when you buy a property, yields can increase a few years down the road,” he says.

Another example is the Mont’Kiara area, which is a mix of own stay and expat tenant community.

“Mont’Kiara is a much improved market in 2017 compared to 2016. There were only minor or no dips in prices and rentals last year. In fact, demand was strong throughout the period,” he shares.

He adds that the slump in rental returns last year was a knee jerk reaction to the oil and gas crash and the overall market will bounce up in the future.

“We also believe rental yields will hover somewhere just above the loan interest rate, unless there are some desperate owners looking to sell their properties below the market price,” he says.

“Hence, now is a good time to invest. In fact, anytime is a good time to invest. As a general rule of thumb, the price of a property in a fairly decent location increases by 100% every 10 years. This is witnessed by a client of mine who bought a property in Sungai Buloh for RM1 million in 2004 and the current market price for the property is approximately RM2.6 million. So, it is very fair to say that property prices will only go up in the long run,” he concludes.

Tips for investors and landlords

Although the decision to invest in the property market depends on one’s risk appetite, preference and expectation of returns, conventional wisdom dictates that investors will remain focused on locations such as the KL city centre, the fringe of the city centre, Mont’Kiara, Sri Hartamas, Bangsar and Damansara Heights, says Foo.

“But more importantly, investors should look for existing developments which currently enjoy higher occupancy rates and therefore are in demand by expatriate and other prospective tenants,” Foo suggests.

For newer developments, he advises investors to take note of those by reputable developers and those who have proven their capabilities to establish well-managed condominiums in the long term.

Besides that, new developments with low to medium density; transit oriented developments that are able to provide conveniences and have the potential to attract more tenants; and developments with energy saving features and less extensive common facilities that can potentially lower service charges, should also be looked at.

On the other hand, Lee advises landlords to put in more effort in enhancing their condos to survive in the current market.

“Undoubtedly, rental rate is the first thing people will consider when looking for a property to rent, but the condition of the unit and furnishing also play a part. Hence, they have to do more — from providing premier furniture to putting in nice decorations and finishing, to attract people to stay in their units,” he counsels.

This story first appeared in EdgeProp.my pullout on Nov 3, 2017.